Annualized Return on Investment (ROI) Calculator

Est. reading time: 5 min

The Annualized Return on Investment (ROI) measures the performance of an investments over a specific period, adjusted to a yearly rate. This adjustment allows for a fair comparison between investments of different durations. The annualized ROI offers a clear perspective on an investment's growth rate, and is an invaluable tool for both individual and institutional investors.

Also try:

Table of Contents

- Word Definitions

- How to Calculate Annualized ROI

- Examples

- Frequently Asked Questions

- Further Reading

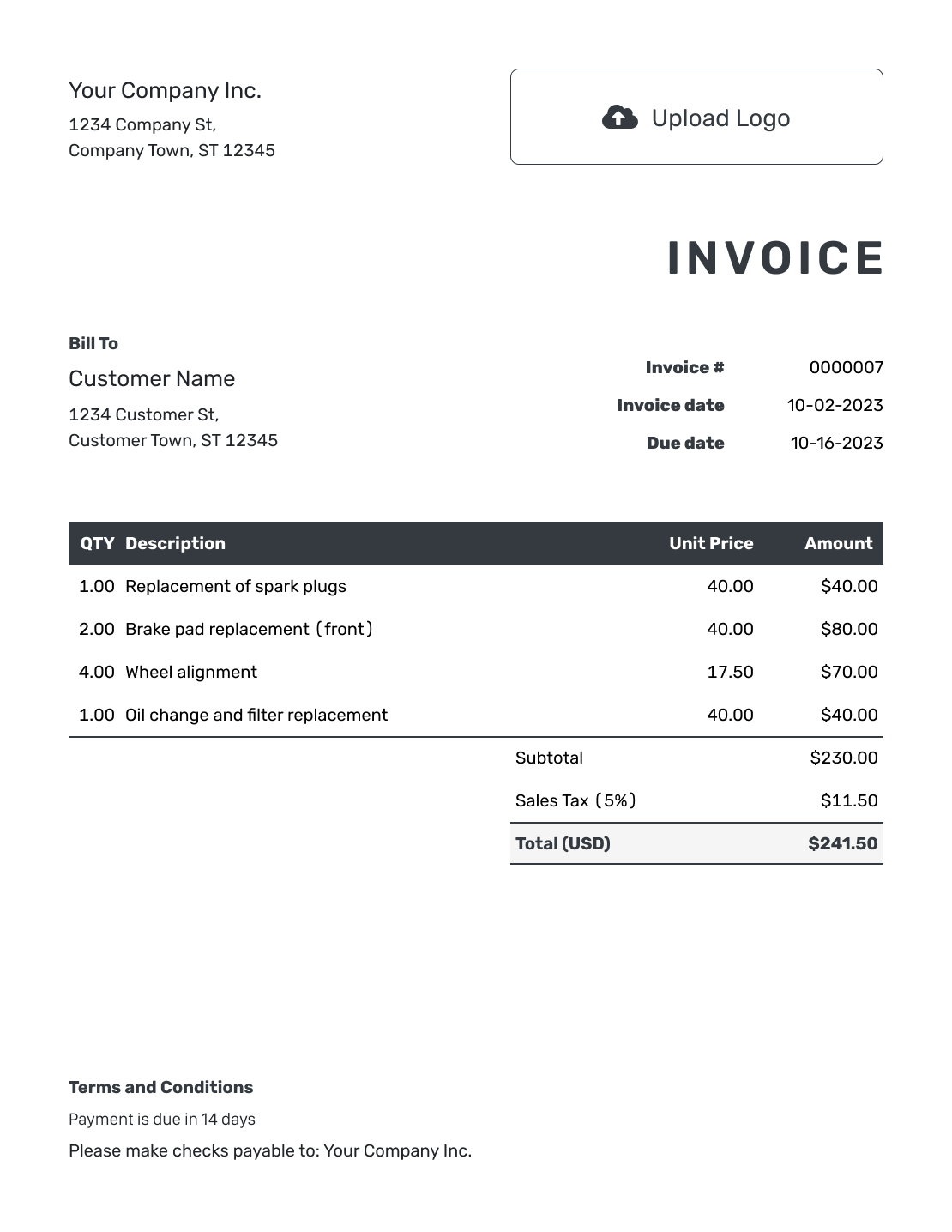

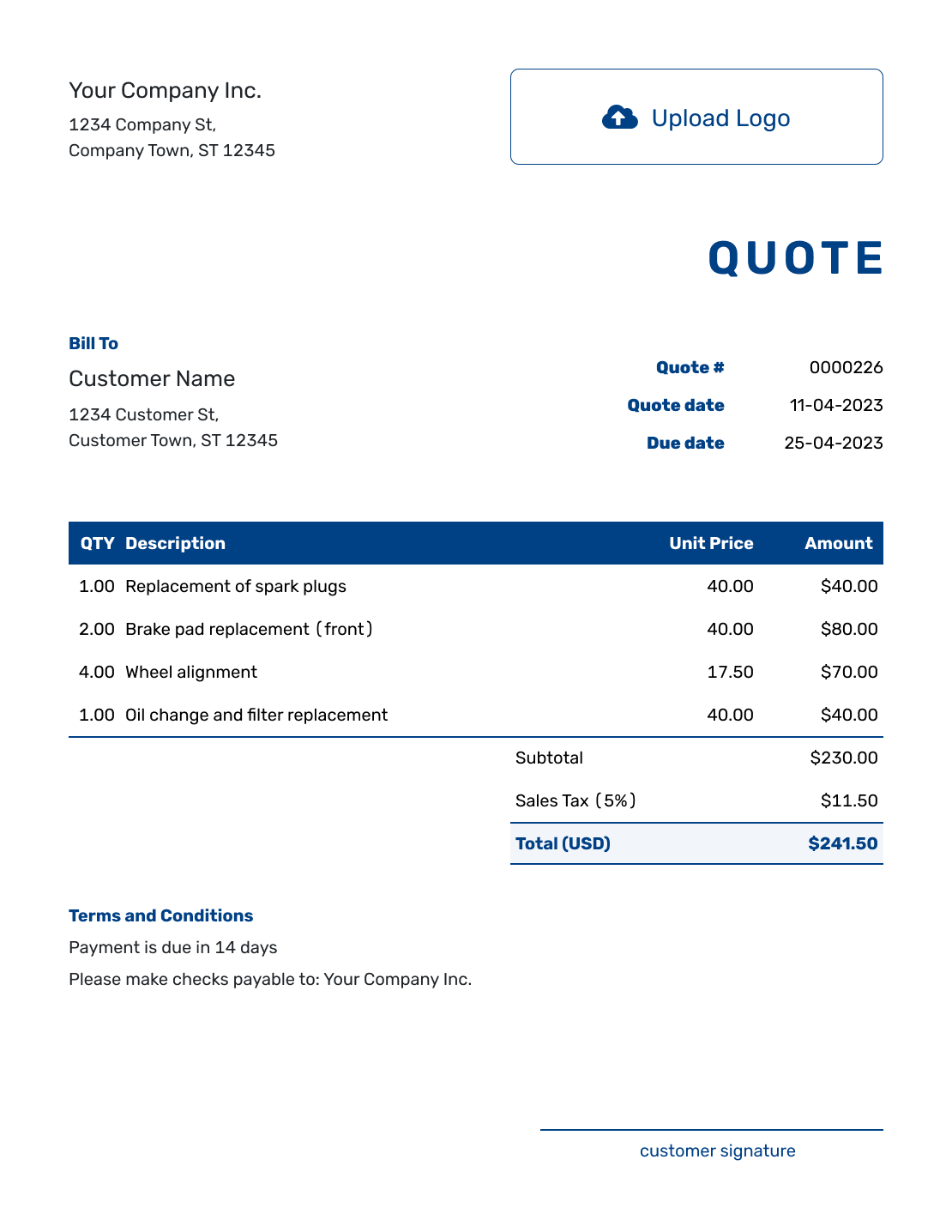

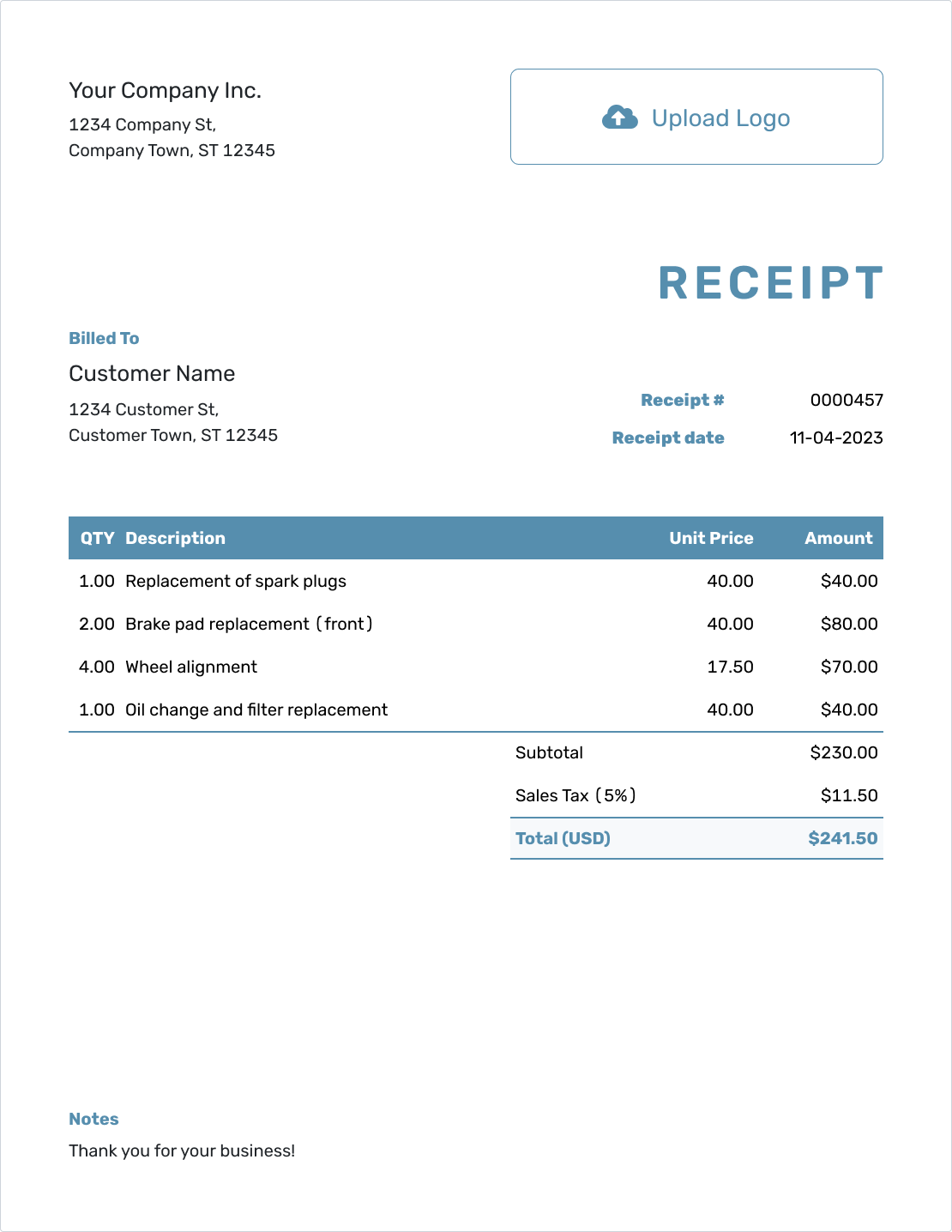

- PDF, Email or Print

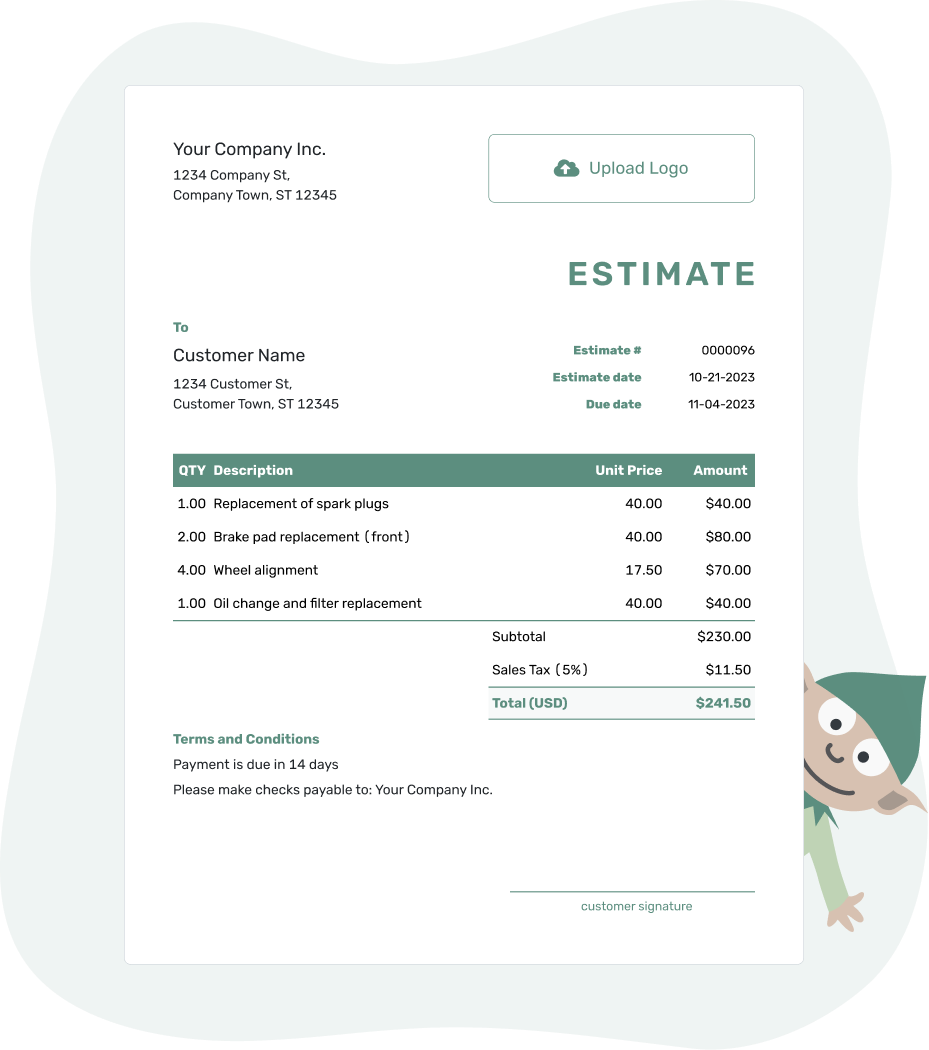

- Convert to Invoice

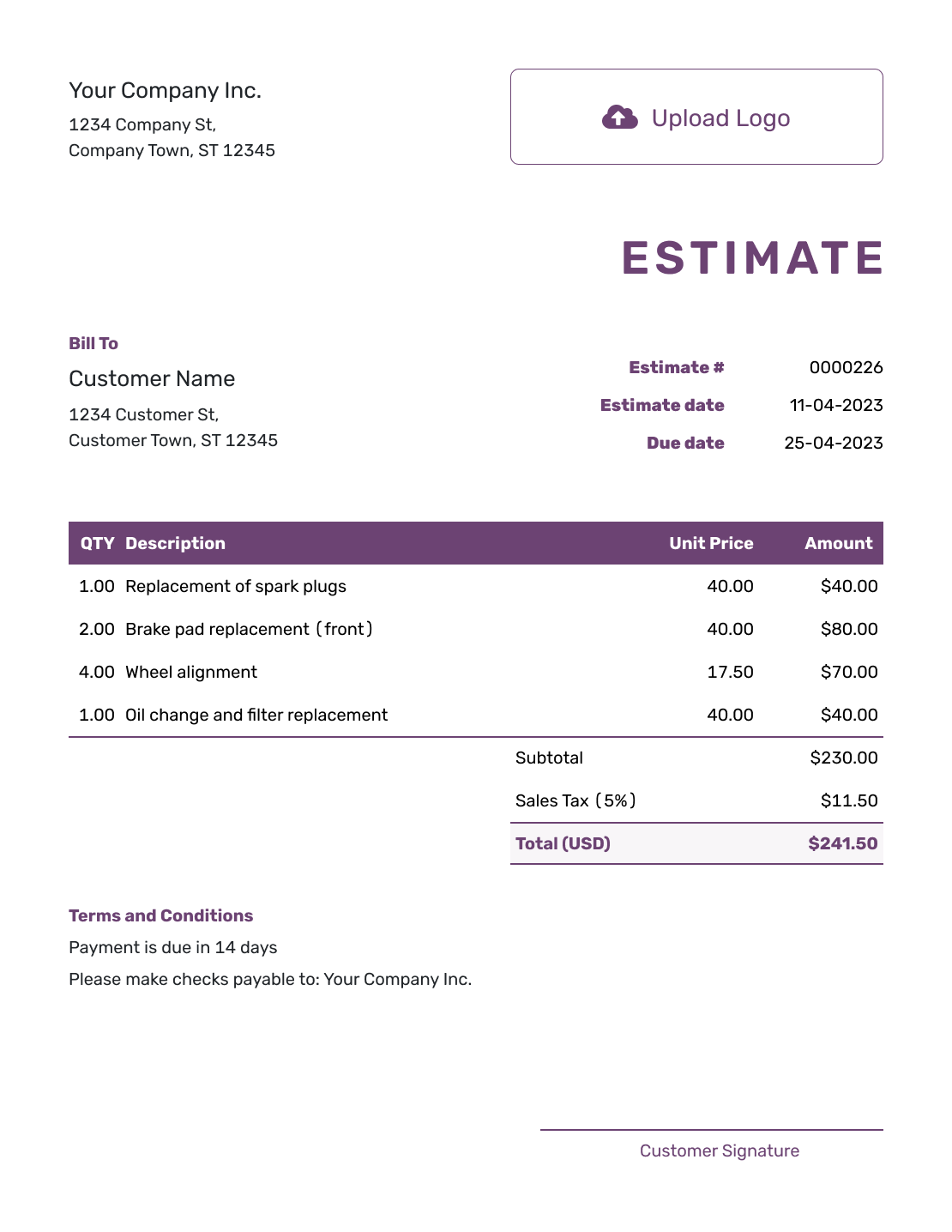

- See when your estimate has been opened

- Get notified when your estimate is accepted

Word Definitions

-

Annualized ROI:

A financial metric that measures the yearly rate of return on an investment, providing a standard measure of profitability over a given period. -

Initial Investment:

The amount of money initially committed to an investment. -

Final Value:

The total value of the investment at the end of the calculation period, including profits and losses. -

Length of Investment:

The total duration the investment is held, typically measured in years.

How to Calculate Annualized ROI

Calculating the annualized ROI involves determining the total return of an investment, adjusting for the length of the investment period, and then annualizing this return. The formula to calculate annualized ROI is:

| Annualized ROI = | [(Final Value / Initial Investment)1/n - 1] × 100% |

where n is the length of the investment in years.

Examples of Annualized ROI Calculation

Here are two practical examples to illustrate how to calculate annualized ROI:

Example 1: Investment in a Stock

Assume you purchased stock worth $10,000 and sold it after 3 years for $16,000. Here’s how you would calculate the annualized ROI:

| Annualized ROI = | [($16,000 / $10,000)1/3 - 1] × 100% |

The calculation would give you an annualized ROI of 16.96%, showing how much the investment grew each year on average, compounded annually.

Example 2: Real Estate Investment

Consider a real estate investment where you purchased a property for $200,000 and sold it 5 years later for $300,000. To find the annualized ROI:

| Annualized ROI = | [($300,000 / $200,000)1/5 - 1] × 100% |

This formula will provide the yearly rate of return of 8.45%, adjusted for compounding over the period of the investment, allowing you to compare it effectively with other investment opportunities that may have different durations.

These examples demonstrate the calculation of annualized ROI, a useful tool for comparing the efficiency of investments with different terms.

Frequently Asked Questions

-

What is annualized ROI?

Annualized ROI is a financial measure used to evaluate the performance of an investment. It adjusts for the duration of investment to express the return as an annual percentage. This standardization allows investors to compare the efficiency of different investments regardless of their duration.

-

How do you calculate annualized ROI?

Annualized ROI is calculated using the formula:

where "n" is the number of years the investment was held. This formula considers the compound interest effect over the investment period to provide a yearly rate of return.Annualized ROI = [(Final Value / Initial Investment)1/n - 1] × 100% -

What is the difference between ROI and annualized ROI?

ROI provides a total return on investment without considering the time period it was invested for, while annualized ROI provides a per-year return rate, making it easier to compare investments of different lengths and compounding effects.

-

When should you use annualized ROI?

Annualized ROI should be used when comparing the performance of investments over periods that do not match. It allows investors to assess the effectiveness and efficiency of different investments on a comparable, annual basis, especially useful in cases involving compound interest.

-

How does compounding affect annualized ROI?

Compounding can significantly impact annualized ROI because it involves the reinvestment of earnings at the same rate of return, leading to exponential growth. The annualized ROI calculation considers this by normalizing the growth rate over each year of the investment period.

Further Reading

To expand your knowledge on annualized ROI and related investment concepts, consider exploring the following resources:

- Investopedia: Annualized Total Return - A guide to understanding the annualized total return on investments and how it's calculated.

- Performance Evaluation: Rateof- Return Measurement - An in-depth analysis on calculating annualized returns and their significance in investment decision-making.