VAT Calculator

Est. reading time: 5 min

VAT, or Value Added Tax, is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale. The amount of VAT that the user pays is on the cost of the product, minus any of the costs of materials used in the product that have already been taxed.

Also try:

Table of Contents

- Word Definitions

- How to Calculate VAT

- Examples

- Reverse VAT Calculation

- VAT Across Different Countries

- Frequently Asked Questions

- Further Reading

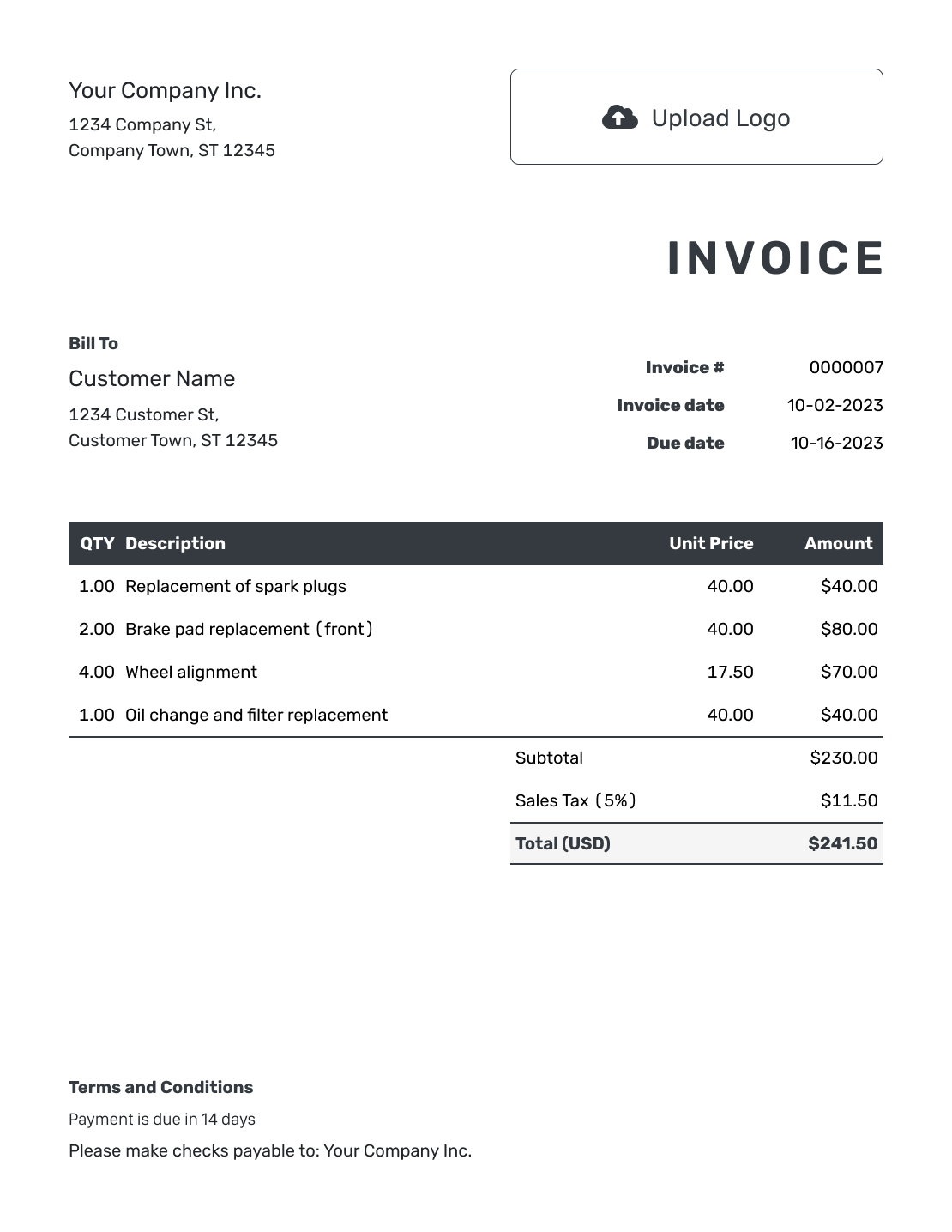

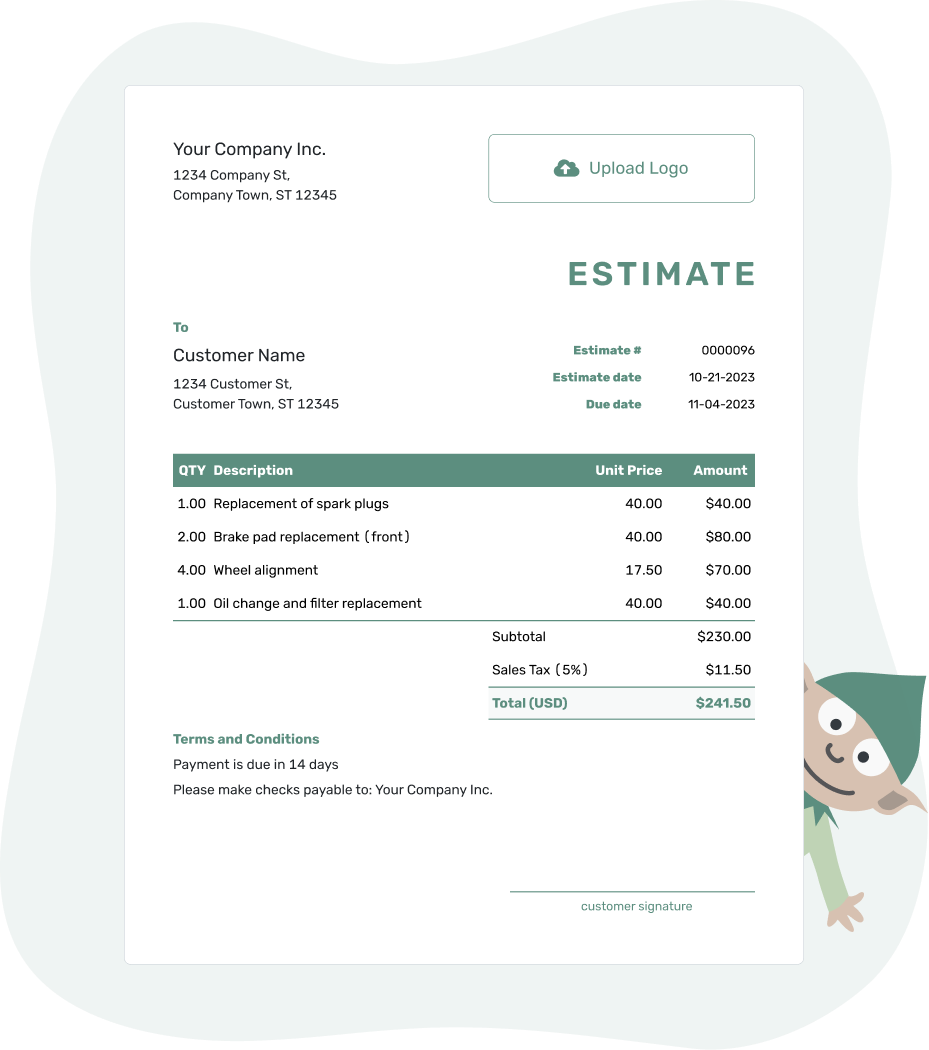

- PDF, Email or Print

- Convert to Invoice

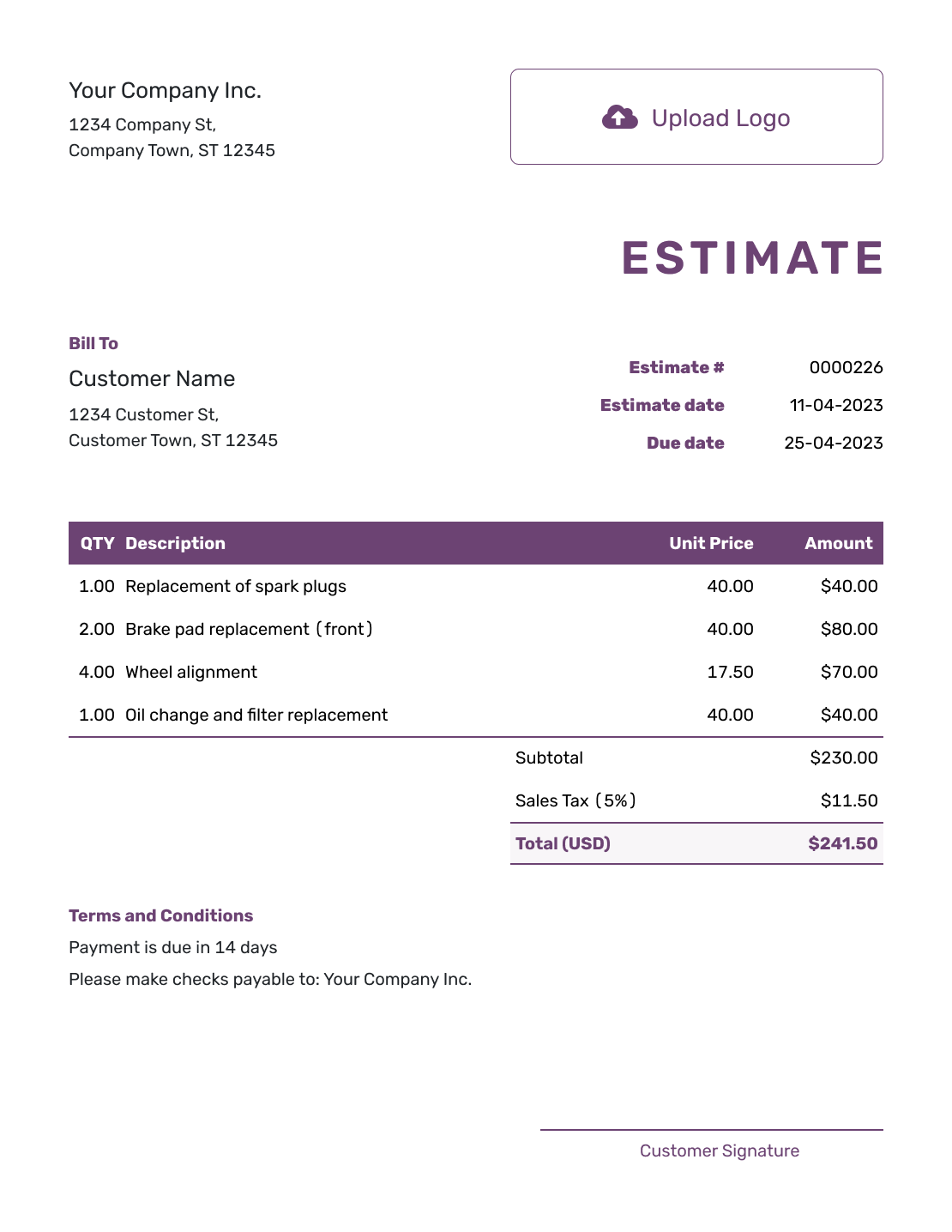

- See when your estimate has been opened

- Get notified when your estimate is accepted

Word Definitions

-

Net Price:

The price of the product before VAT is added. -

VAT Rate:

The percentage that is charged as VAT on top of the net price. -

Gross Price:

The total price of the product including VAT.

How to Calculate VAT

To calculate VAT, you first multiply the net price of the item by the VAT rate like this:

| VAT Amount = | Net Price × VAT Rate |

To find the total price including VAT, you then add the VAT amount to the net price:

| Gross Price = | Net Price + VAT Amount |

We can combine the two equations above to obtain a single VAT equation:

| Gross Price = | Net Price × (1 + VAT Rate) |

Examples of VAT Calculation

Here are detailed examples to help you understand how to calculate VAT using the formula provided:

Example 1: VAT on Electronic Goods

Imagine you are purchasing a camera for personal use. The net price of the camera is $1,000 and the applicable VAT rate is 15%. To find the gross price that you will pay at the checkout, use the following formula:

| Gross Price = | $1,000 × (1 + 15%) |

This calculation results in a gross price of $1,150, which is the total amount you will pay for the camera including VAT.

Example 2: VAT on Services

Consider a scenario where you are hiring a graphic designer for a project, and the agreed net service fee is $2,500. If the VAT rate is 20%, you can calculate the gross amount to be paid as follows:

| Gross Price = | $2,500 × (1 + 20%) |

This formula will give you a total payment of $3,000, which includes the VAT on the services provided.

These examples demonstrate how VAT is calculated on both goods and services, providing clear totals that include tax, which is crucial for budgeting and financial planning.

Reverse VAT Calculation

Sometimes, you may need to determine the net price of an item or service if you only know the gross price that includes VAT. This process is known as reverse VAT calculation. It is particularly useful in accounting and bookkeeping, where you need to record the base price without tax.

Understanding Reverse VAT Calculation

Reverse VAT calculation involves working backward from the total amount paid (the gross price) to determine the original price before VAT was added (the net price). This is accomplished by dividing the gross price by the sum of 1 plus the VAT rate.

The formula to calculate the net price from the gross price is:

| Net Price = | Gross Price |

| 1 + VAT Rate |

Example of Reverse VAT Calculation

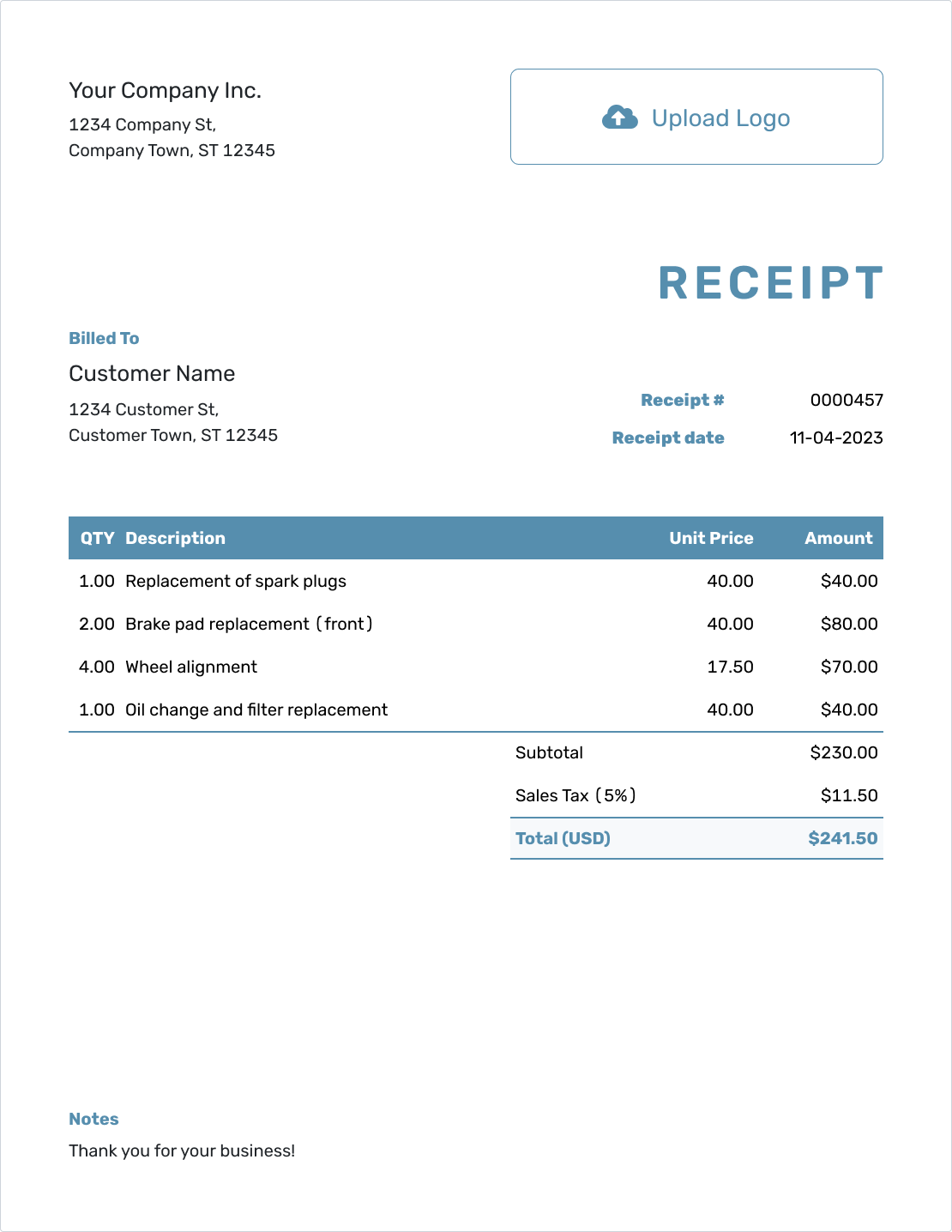

Suppose you have purchased office supplies and received a receipt stating a gross amount of $230, with a VAT rate of 15%. To find out how much of that is the base price before VAT, you would use the reverse VAT calculation:

| Net Price = | $230 |

| 1 + 15% |

This calculation gives a net price of approximately $200, indicating that $30 was added as VAT. Knowing the net price is essential for correctly recording the cost of goods or services exclusive of tax.

Reverse VAT calculation is crucial in situations where pricing transparency is necessary, such as in detailed financial reporting or when you need to back-calculate the original prices after tax for bookkeeping accuracy.

VAT Across Different Countries

VAT rates vary significantly around the world, reflecting different policies. For instance, the standard VAT rate in the UK is 20%, while Canada uses a Goods and Services Tax (GST) rate of 5%. Understanding these differences is essential for international trade and business.

Frequently Asked Questions

-

What is VAT?

VAT, or Value Added Tax, is a type of indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. It is usually included in the price paid by the final consumer, making it a consumption tax.

-

How does VAT differ from sales tax?

While both VAT and sales tax are types of consumption tax, they differ in how they are collected. VAT is charged at each step of the supply chain, with businesses collecting and remitting tax on the value they add. Sales tax, on the other hand, is only collected at the point of final sale to the consumer.

-

How do you calculate VAT?

To calculate VAT, you multiply the net price of the goods or services by the VAT rate appropriate to the product or service. To find the total cost including VAT, add the VAT amount to the net price.

Gross Price = Net Price × (1 + VAT Rate) -

How is reverse VAT calculation done?

Reverse VAT calculation is used to determine the net price from a total price that includes VAT. This is done by dividing the total price by 1 plus the VAT rate.

Net Price = Gross Price 1 + VAT Rate For example, if the total price is $120 and the VAT rate is 20%, the net price would be calculated as $120 / 1.2 = $100.

-

Who needs to register for VAT?

Businesses with a turnover exceeding a certain threshold, which varies by country, need to register for VAT. Once registered, they must charge VAT on taxable goods and services they supply.

-

Can businesses reclaim VAT?

Yes, registered businesses can generally reclaim the VAT they have paid on goods and services used in the course of their business. This helps avoid double taxation and reduces the overall tax burden on the business.

Further Reading

To deepen your understanding of VAT and its implications across various jurisdictions, explore the following resources:

- OECD's Global Forum on VAT - Provides a comprehensive platform for discussing international VAT issues and trends, fostering better understanding and cooperation among countries.

- European Commission VAT in the Digital Age - Offers detailed information on VAT policies within the European Union, including regulations, rates, and guidance for businesses and individuals.

- VAT Guide (Notice 700) from HM Revenue & Customs - A guide to VAT rules and procedures in the United Kingdom, providing crucial information for compliance and understanding VAT operations.

- Australian Taxation Office - GST (Goods and Services Tax) - Offers resources and guidance on managing GST in Australia, which is similar to VAT, including how to register, calculate, and submit GST.

These resources provide valuable insights and guidance that can help both individuals and businesses better understand and manage VAT.