Sales Tax Calculator

Est. reading time: 5 min

In everyday transactions, whether you're buying a latte or a laptop, sales tax is an inevitable part of most purchases. This additional charge can sometimes catch consumers by surprise, altering the final amount paid at the checkout.

For businesses, understanding and correctly applying sales tax is a critical aspect of operations, ensuring compliance with local laws and regulations. This guide aims to simplify the concept of sales tax, making it more accessible through straightforward explanations, practical examples, and answers to common questions.

Also try:

Table of Contents

- What is Sales Tax?

- Word Definitions

- How to Calculate Sales Tax

- Examples

- Sales Tax Across the United States

- Frequently Asked Questions

- Further Reading

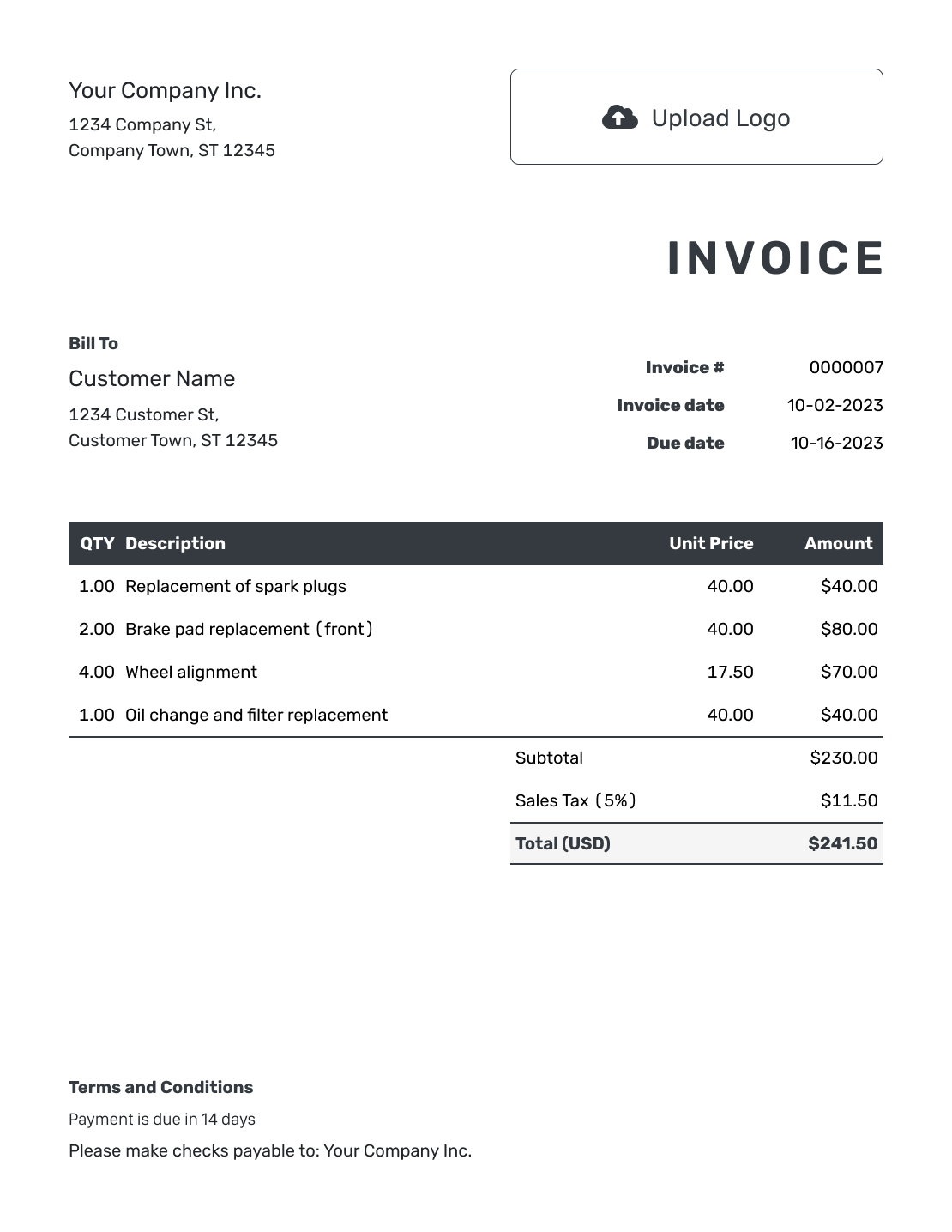

- PDF, Email or Print

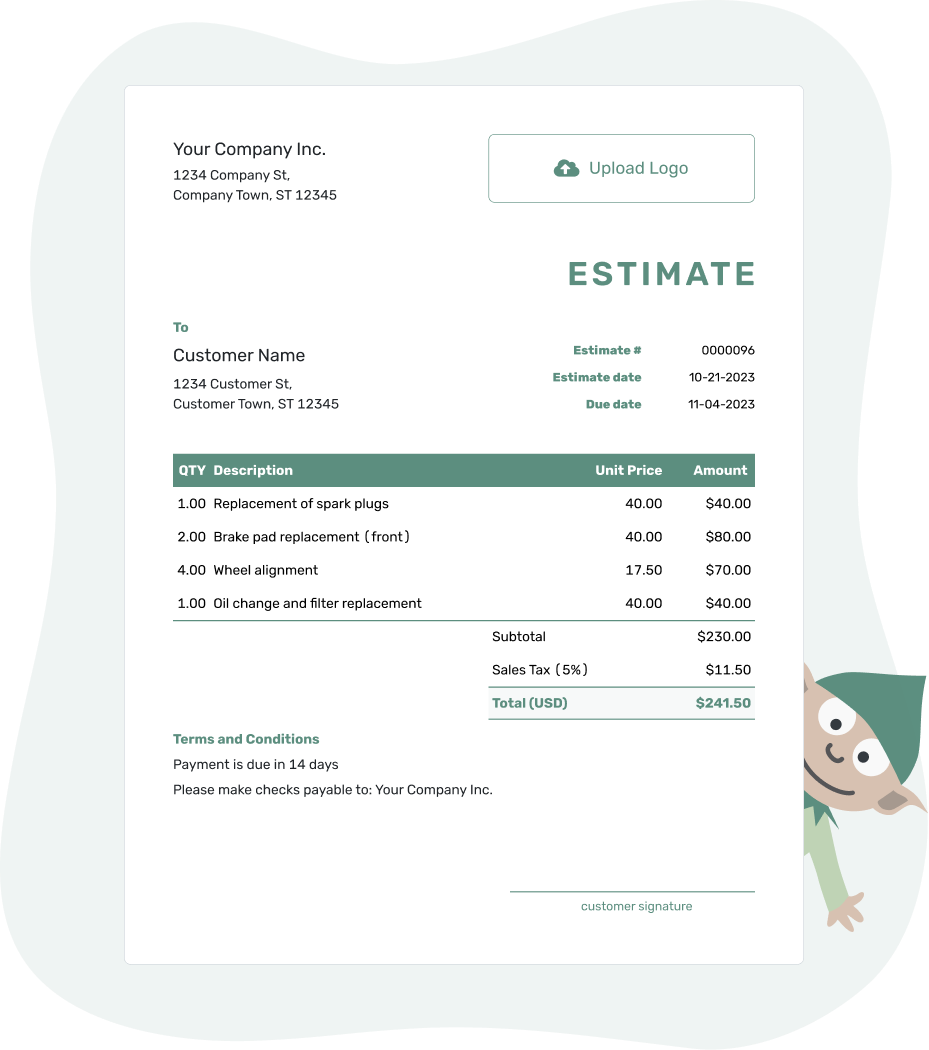

- Convert to Invoice

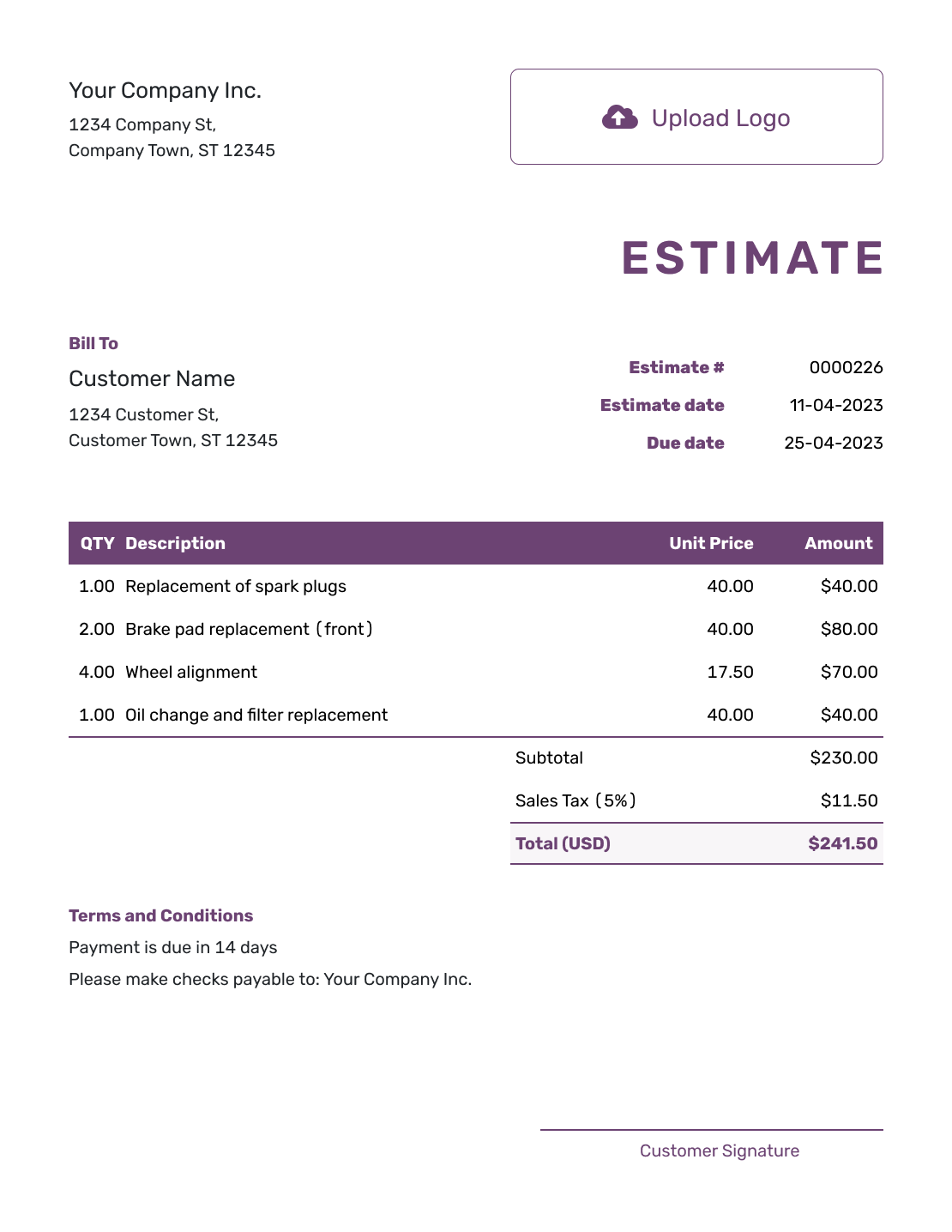

- See when your estimate has been opened

- Get notified when your estimate is accepted

What is Sales Tax?

Sales tax is a consumption tax imposed by government authorities on the sale of goods and services. When a customer purchases a taxable item, the merchant adds sales tax to the item's price, making the consumer responsible for paying the tax. This tax is then remitted to the government by the business, serving as a significant source of revenue for state and local governments. Unlike a value-added tax (VAT), which is applied at each stage of production and not visible to the final consumer, sales tax is only charged to the end consumer at the point of sale.

Word Definitions

-

Price Before Tax:

The cost of an item before the addition of sales tax. -

Sales Tax Rate:

The percentage of the before-tax price that is added to the purchase as sales tax. -

Price After Tax:

The total cost of the item, including sales tax.

How to Calculate Sales Tax

To calculate sales tax, you multiply the price of the item (before tax) by the sales tax rate. The formula looks like this:

| Sales Tax = | Price Before Tax · Sales Tax Rate |

To find the total price with sales tax included, simply add the sales tax to the before-tax price:

| Total Price = | Price Before Tax + Sales Tax |

It can also be expressed in a single formula:

| Total Price = | Price Before Tax · (1 + Sales Tax Rate) |

Examples of Sales Tax Calculation

To calculate Sales Tax along with the total price after tax, we can use the two formulas:

| Sales Tax = | Price Before Tax · Sales Tax Rate |

| Total Price = | Price Before Tax + Sales Tax |

where Price Before Tax is the cost of the item before tax, and Sales Tax Rate is the percentage rate at which the item is taxed.

Using the formulas above, we can calculate some common Sales Tax amounts:

Example 1: Sales Tax on a $200 Item with a 7% Tax Rate

If the price before tax of an item is $200 and the sales tax rate is 7%, then the sales tax amount can be calculated as follows:

| Sales Tax = | $200 · 7% |

which is equal to $14.

The total price after tax is then:

| Total Price = | $200 + $14 |

which is equal to $214.

Example 2: Sales Tax on a $150 Item with an 8.5% Tax Rate

For an item priced at $150 with an 8.5% sales tax rate, the sales tax would be calculated as:

| Sales Tax = | $150 · 8.5% |

which results in a sales tax amount of $12.75.

The total price after tax is then:

| Total Price = | $150 + $12.75 |

which is equal to $162.75.

Sales Tax Across the United States

Sales tax rates and rules vary significantly across the United States, with some states imposing no sales tax at all (Alaska, Delaware, Montana, New Hampshire, and Oregon). Other states have a statewide sales tax rate and allow localities to add additional taxes, leading to a wide range of total sales tax rates within a single state. For example, in California, the base state sales tax rate is 7.25%, but local jurisdictions can add their own taxes, resulting in total rates as high as 10.50%.

Sales Tax Rates

Sales tax rates in the United States can vary widely between jurisdictions and are subject to change. Below is an overview of sales tax by US state. For the most current and detailed information on sales tax rates across different states and local jurisdictions, it's advisable to consult the official state department of revenue website.

| Jurisdiction | Base sales tax | Total with max local surtax |

|---|---|---|

| Alabama | 4% | 13.5% |

| Alaska | 0% | 7% |

| Arizona | 5.6% | 10.725% |

| Arkansas | 6.5% | 11.625% |

| California | 7.25% | 10.5% |

| Colorado | 2.9% | 10% |

| Connecticut | 6.35% | 6.35% |

| Delaware | 0% | 0% |

| District of Columbia | 6% | 6% |

| Florida | 6% | 7.5% |

| Georgia | 4% | 8% |

| Guam | 4% | 4% |

| Hawaii | 4.166% | 4.712% |

| Idaho | 6% | 8.5% |

| Illinois | 6.25% | 10.25% |

| Indiana | 7% | 7% |

| Iowa | 6% | 7% |

| Kansas | 6.5% | 11.6% |

| Kentucky | 6% | 6% |

| Louisiana | 4.45% | 11.45% |

| Maine | 5.5% | 5.5% |

| Maryland | 6% | 6% |

| Massachusetts | 6.25% | 6.25% |

| Michigan | 6% | 6% |

| Minnesota | 6.875% | 7.875% |

| Mississippi | 7% | 7.25% |

| Missouri | 4.225% | 10.85% |

| Montana | 0% | 0% |

| Nebraska | 5.5% | 7.5% |

| Nevada | 6.85% | 8.375% |

| New Hampshire | 0% | 0% |

| New Jersey | 6.625% | 12.625% |

| New Mexico | 5.125% | 8.688% |

| New York | 4% | 8.875% |

| Nortd Carolina | 4.75% | 7.50% |

| Nortd Dakota | 5% | 8% |

| Ohio | 5.75% | 8% |

| Oklahoma | 4.5% | 11% |

| Oregon | 0% | 0% |

| Pennsylvania | 6% | 8% |

| Puerto Rico | 10.5% | 11.5% |

| Rhode Island | 7% | 7% |

| Soutd Carolina | 6% | 9% |

| Soutd Dakota | 4% | 6% |

| Tennessee | 7% | 9.75% |

| Texas | 6.25% | 8.25% |

| Utah | 6.1% | 8.35% |

| Vermont | 6% | 7% |

| Virginia | 5.3% | 7.0% |

| Washington | 6.5% | 10.6% |

| West Virginia | 6% | 7% |

| Wisconsin | 5% | 7.9% |

| Wyoming | 4% | 6% |

Frequently Asked Questions

-

Who is responsible for collecting sales tax?

Businesses collect sales tax from consumers at the point of sale and remit it to the appropriate tax authority.

-

Does sales tax apply to online purchases?

Yes, online purchases are subject to sales tax if the seller has a physical presence (nexus) in the state where the purchase is delivered.

-

Are all items subject to sales tax?

No, exemptions vary by state but often include groceries, prescription medications, and educational materials.

-

How often do sales tax rates change?

Sales tax rates can change, but any changes are typically announced by tax authorities well in advance, allowing businesses to update their systems.

-

What is Value Added Tax (VAT)?

Value Added Tax (VAT) is a type of general consumption tax that is collected incrementally, based on the surplus value of the product or service, at each stage of production or distribution. It is typically imposed on the price of a product or service at each stage where value is added, from raw materials to the final retail purchase.

Essentially, it is a tax on the amount by which the value of an article has been increased at each stage of its production or distribution. The final consumer pays the VAT cost, while businesses collect and account for the tax, acting as tax collectors on behalf of the government.

-

What is the difference between Sales Tax and VAT?

The main difference between Sales Tax and Value Added Tax (VAT) lies in the stage at which the tax is collected. Sales Tax is a single-stage tax, applied to the final sale to the consumer and collected by the retailer at the point of sale. It is charged directly to the consumer, and the retailer then remits the collected tax to the government. The consumer bears the entire tax cost.

Conversely, VAT is a multi-stage tax, applied at each stage of the production and distribution process whenever value is added. Although the final consumer pays the VAT on the purchase price, businesses at each stage of the process can claim a credit for the VAT already paid, making the consumer the ultimate bearer of the tax. VAT provides a comprehensive and continuous chain of tax payments, which can make it a more efficient and often more transparent taxation method compared to sales tax.

Further Reading

Interested in delving deeper into the topic of sales tax? Below are some resources that offer additional insights and information:

- The Sales Tax Deduction Calculator on the IRS website helps individuals determine the amount of state and local general sales tax they can claim when itemizing deductions on Schedule A (Forms 1040 or 1040-SR). It provides insights into how sales tax deductions work and the limits imposed on deductions for state and local income, sales, and property taxes.

- The Wikipedia page on Sales Taxes in the United States offers a comprehensive overview of sales tax policies across the country. It includes historical context, state-by-state variations, and specific details such as rates, exemptions, and the governance of sales tax at the state level. This article is a great starting point for understanding the diversity of sales tax laws and their impact on consumers and businesses alike.