GST Tax Calculator

Est. reading time: 5 min

GST, or Goods and Services Tax, is a tax on goods and services sold domestically for consumption. The tax is included in the final price and paid by consumers at the point of sale and passed on to the government by the seller. GST provides revenue for the government and theoretically does not create a tax burden on the businesses.

Also try:

Table of Contents

- Word Definitions

- How to Calculate GST

- Examples

- Reverse GST Calculation

- GST Across Different Countries

- Frequently Asked Questions

- Further Reading

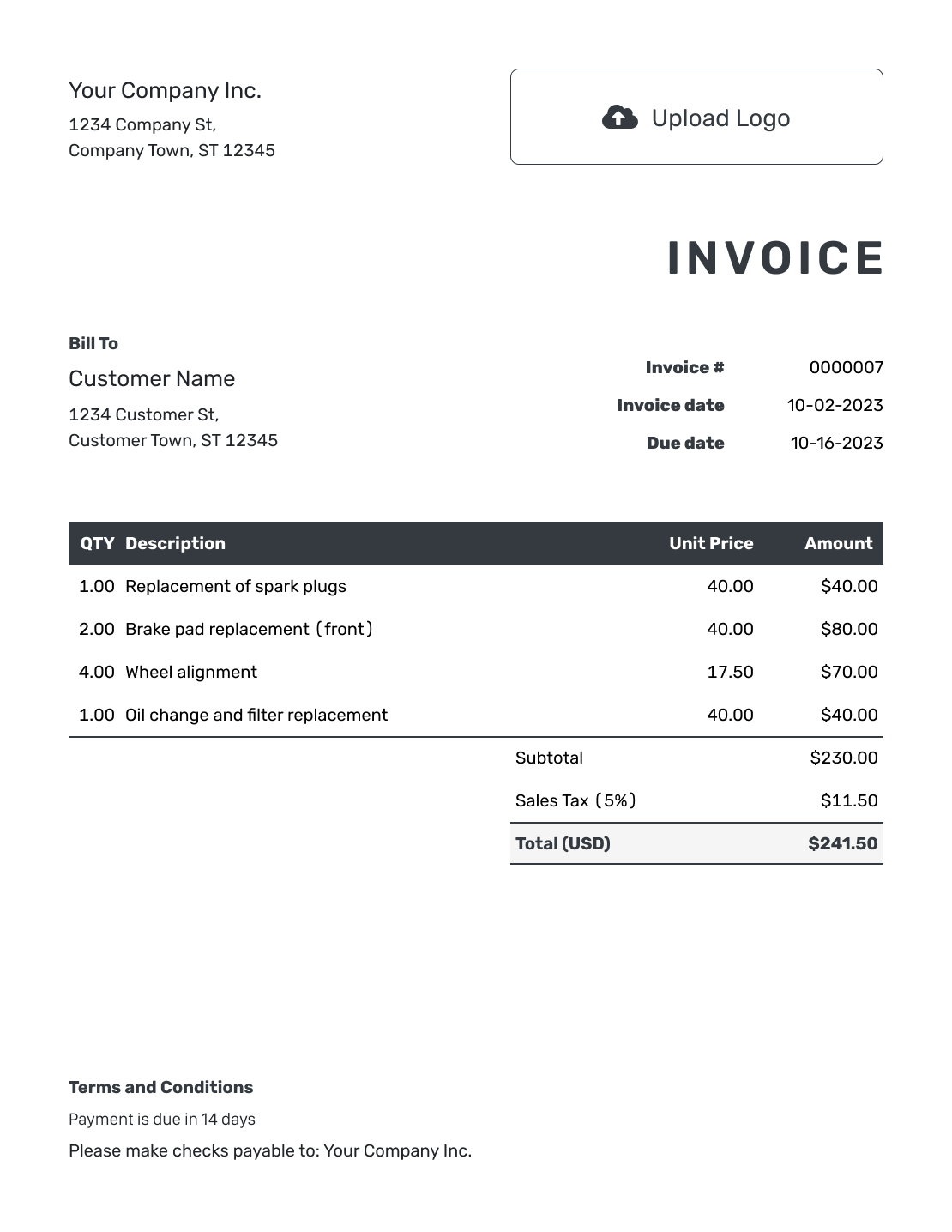

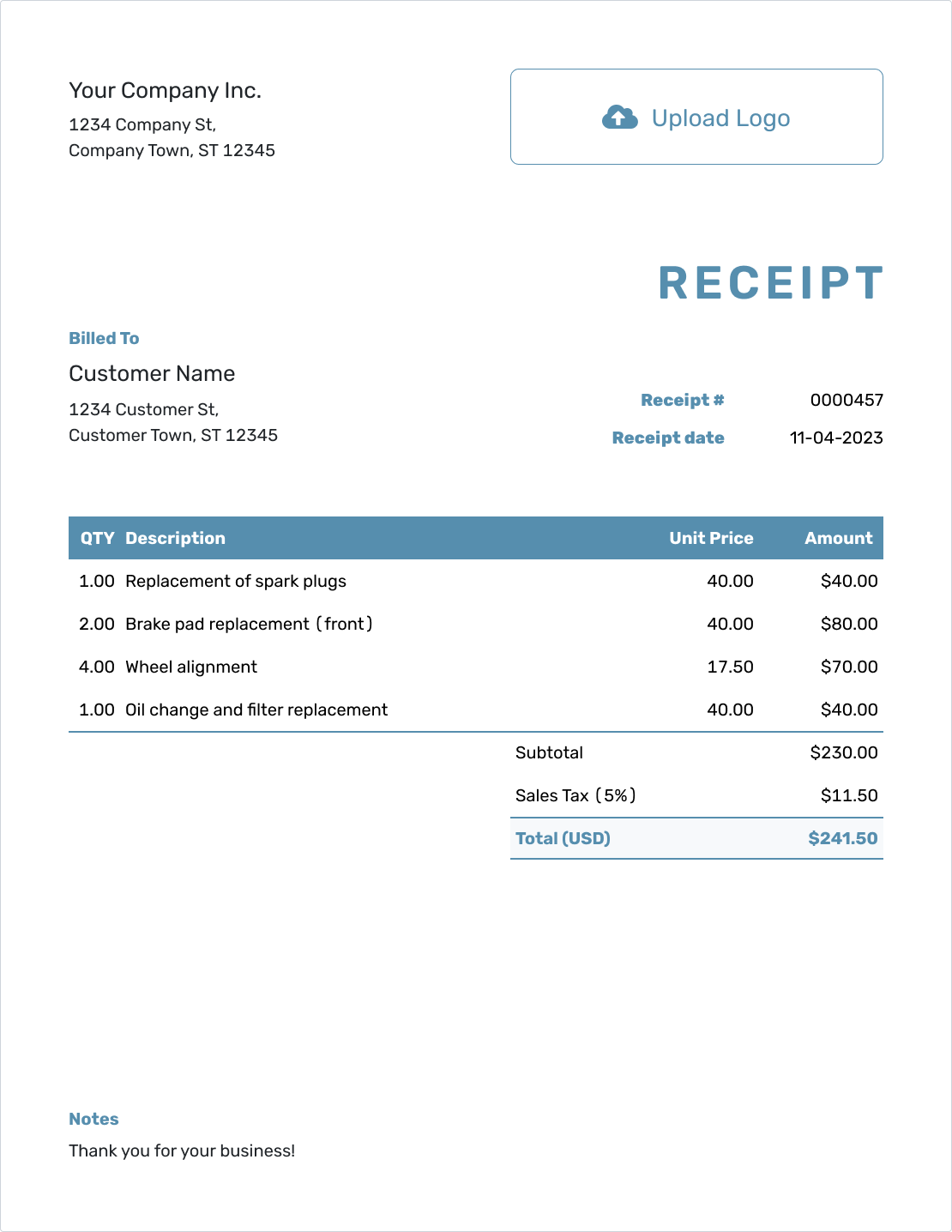

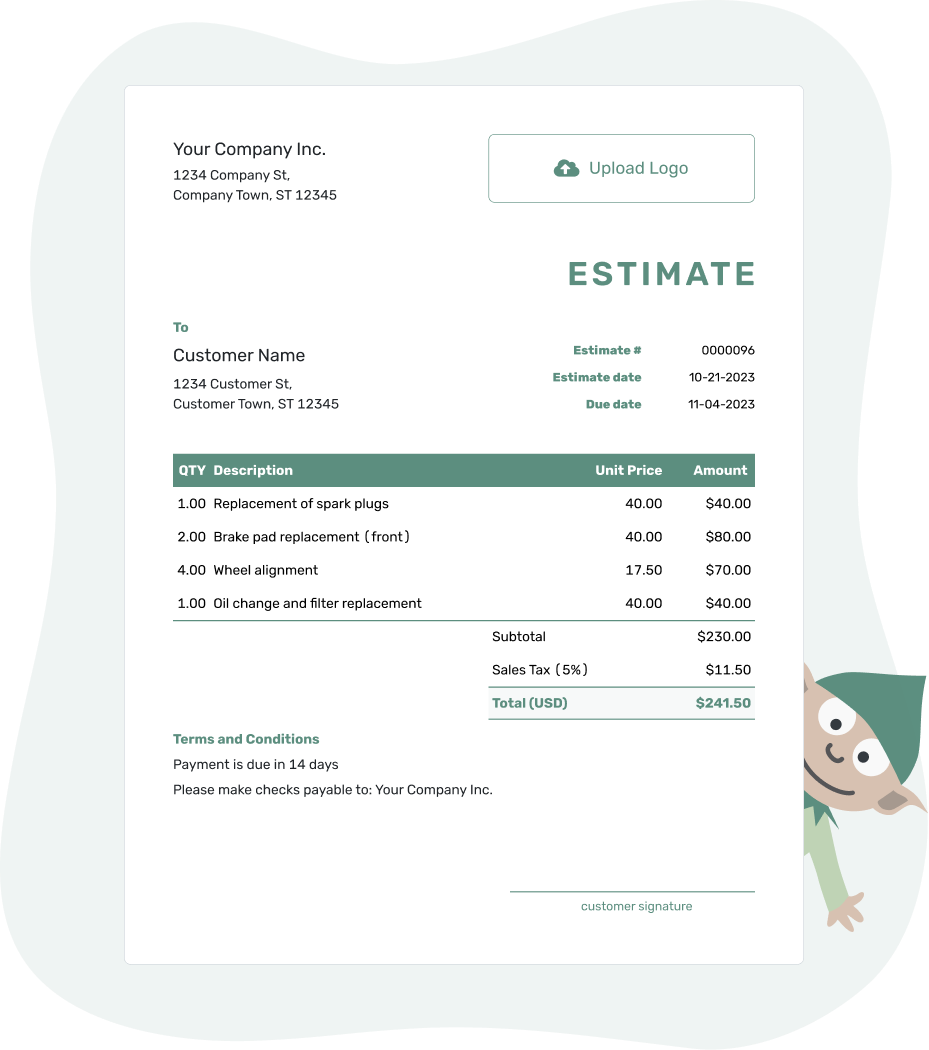

- PDF, Email or Print

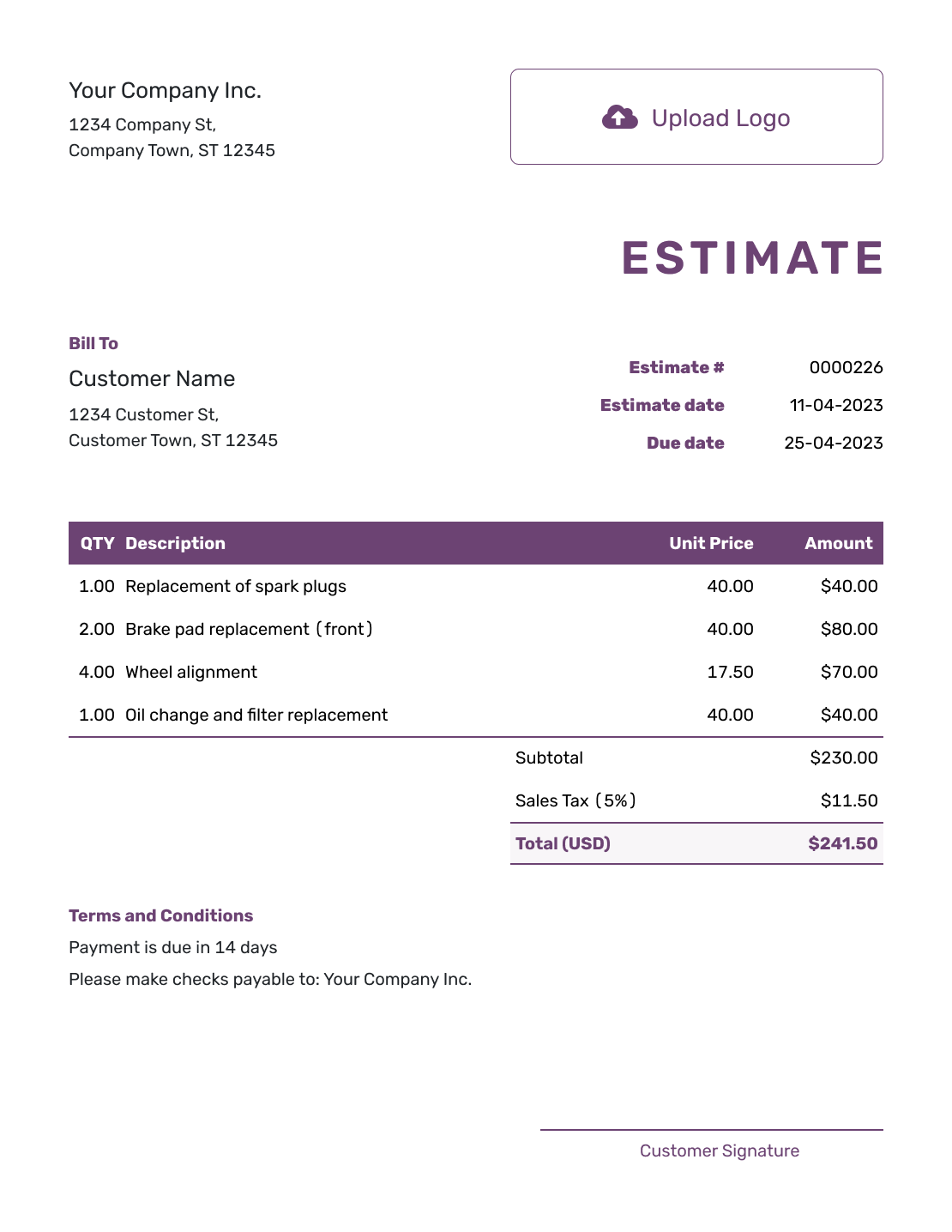

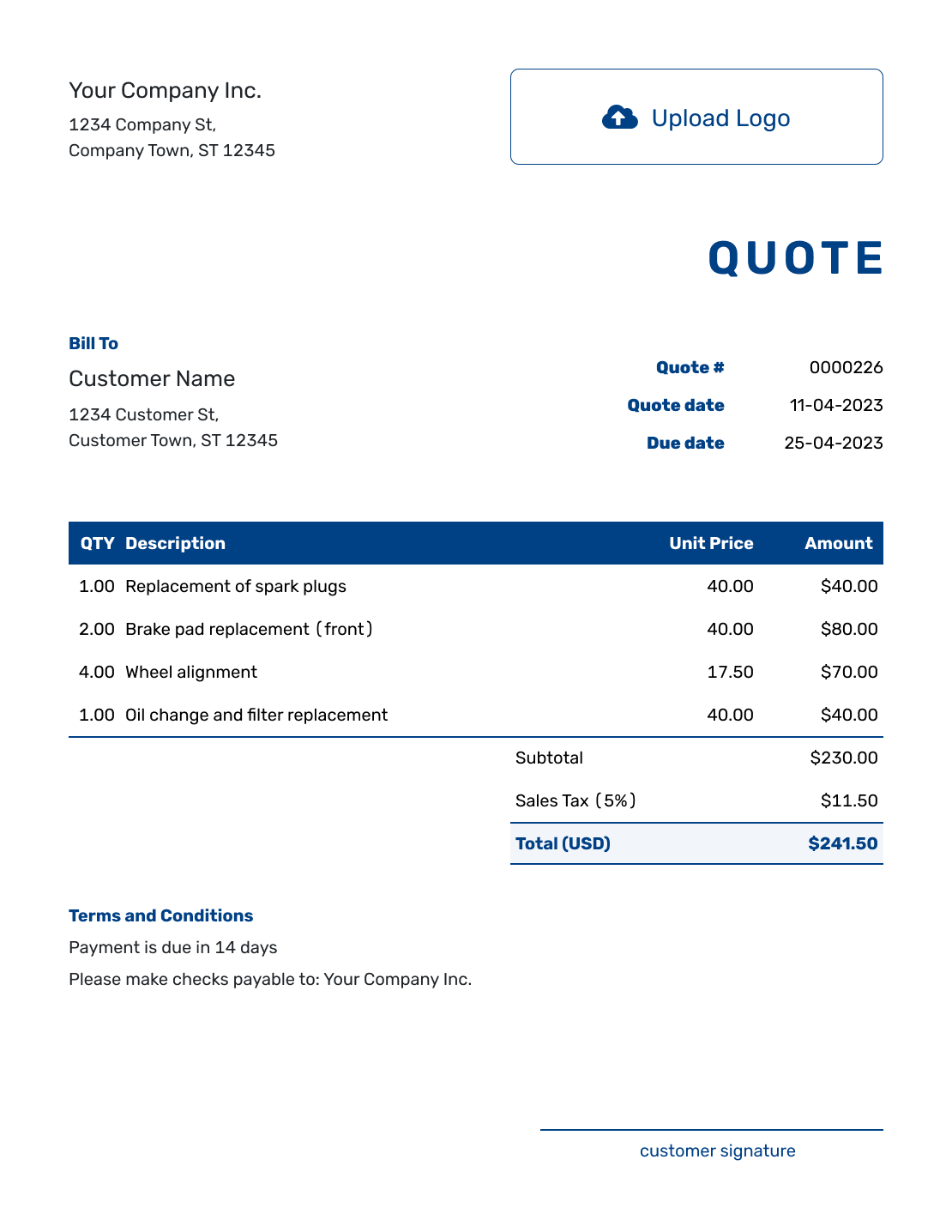

- Convert to Invoice

- See when your estimate has been opened

- Get notified when your estimate is accepted

Word Definitions

-

Net Price:

The price of the product or service excluding GST. -

GST Rate:

The rate at which GST is levied on the product or service. This rate varies between different countries and sometimes within different regions of a country. -

Gross Price:

The total price including GST. This is the amount that the customers actually pay.

How to Calculate GST

Calculating GST involves determining the net cost of goods or services and then adding the GST to find the gross cost that the consumer will pay.

Start by calculating the GST amount which we can find by multiplying the net price with the GST rate:

| GST Amount = | Net Price × GST Rate |

| Gross Price = | Net Price + GST Amount |

| Gross Price = | Net Price × (1 + GST Rate) |

Examples of GST Calculation

These examples will help illustrate how GST is calculated in practical scenarios:

Example 1: GST on Electronic Gadgets

Imagine you are buying a smartphone in a country where the GST rate is 10%. The net price of the smartphone is $500. To calculate the GST amount and the total price you will pay, use the following formula:

| Gross Price = | $500 × (1 + 10%) = $550 |

This means the total amount you will pay for the smartphone, including GST, is $550.

Example 2: GST on Professional Services

Consider you are hiring a consultant for business services, and the net service fee is $2,000 with a GST rate of 15%. To determine the total cost including GST, use the calculation below:

| Gross Price = | $2,000 × (1 + 15%) = $2,300 |

The total fee for the consultant services including GST will be $2,300.

Reverse GST Calculation

When you know the gross amount and need to find out the net price before GST, you use the reverse GST calculation.

The formula to calculate the net price from the gross price that includes GST is:

| Net Price = | Gross Price |

| 1 + GST Rate |

GST Across Different Countries

Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption. Consumers pay the GST, but it is remitted to the government by the businesses selling the goods and services. The implementation, rate, and structure of GST can vary significantly from country to country. Here are the details on how GST is applied in several countries, including Australia, Canada, and New Zealand.

Australia

- GST Rate: 10%

- Implementation Date: Introduced in 2000.

- Coverage: Applies to most goods, services, and other items sold or consumed in Australia.

- Unique Features: Some items like basic food, certain medical, educational, and health services are exempt from GST in Australia. Businesses that are registered for GST can claim tax credits for the GST included in the price of goods and services they have bought for their business.

Canada

- GST Rate: 5%

- Implementation Date: Introduced in 1991.

- Coverage: Applies across all Canadian provinces. However, some provinces combine GST with a provincial sales tax (PST) to create a harmonized sales tax (HST).

- Unique Features: Each province decides whether to use GST, PST, or HST. For example, Ontario uses an HST of 13%, which combines both GST and PST. Basic groceries, prescription drugs, and certain medical devices are exempt from GST/HST.

New Zealand

- GST Rate: 15%

- Implementation Date: Introduced in 1986.

- Coverage: Covers almost all goods and services with very few exemptions.

- Unique Features: Unlike many other countries, New Zealand has very few exceptions to GST. It does not exempt food, healthcare, or educational services.

Frequently Asked Questions

-

What is GST?

GST, or Goods and Services Tax, is a multi-stage, comprehensive, destination-based tax that is levied on every value addition. Unlike a singular sales tax, it is imposed at every step in the production process but is meant to be refunded to all parties in the various stages of production other than the final consumer.

-

How does GST differ from traditional sales tax?

GST is levied at every stage of the production process and is designed to be collected from each point of value addition, which makes it a multi-stage tax. In contrast, traditional sales tax is typically a single-stage tax charged only at the point of sale, paid by the retail customer.

-

How do you calculate GST?

GST calculation can be done by adding the GST percentage to the net price of goods or services. For instance, if the GST rate is 10% and the net price of the goods is $100, the GST would be $10, making the total price $110.

Gross Price = $100 × (1 + 10%) = $110 -

How is reverse GST calculation done?

Reverse GST calculation is performed to determine the net price if only the gross price is known. It involves dividing the total amount paid by 1 plus the GST rate. For example, if the total amount including GST is $110 and the GST rate is 10%, the net price would be $100.

$110 = $100 1 + 10% -

Who needs to register for GST?

Businesses with a turnover above a certain threshold, which varies by country, are required to register for GST. This threshold is different in every country that implements GST. Once registered, businesses are required to charge GST on all eligible sales.

-

Can businesses reclaim GST?

Yes, businesses that are registered for GST can generally reclaim the GST they have paid on business-related purchases. This system ensures that the tax is effectively paid by the final consumer.

Further Reading

For those interested in a deeper dive into GST and its applications:

- Australian Taxation Office: GST - Details on how GST is implemented and handled in Australia.

- Canada Revenue Agency: GST/HST - Information on the goods and services tax and harmonized sales tax in Canada.

- Inland Revenue Department New Zealand: GST - Guidance on GST from the New Zealand government.