Beginning Inventory Calculator

Est. reading time: 7 min

Beginning inventory refers to the value of goods available for sale at the start of an accounting period. It is a crucial metric for businesses in managing inventory levels, calculating cost of goods sold (COGS), and understanding financial health. This article will introduce you to the concept of beginning inventory and explain how to calculate it using our calculator.

Also try:

Table of Contents

- Word Definitions

- How to Calculate Beginning Inventory

- Examples

- How to Calculate Inventory Turnover

- Frequently Asked Questions

- Further Reading

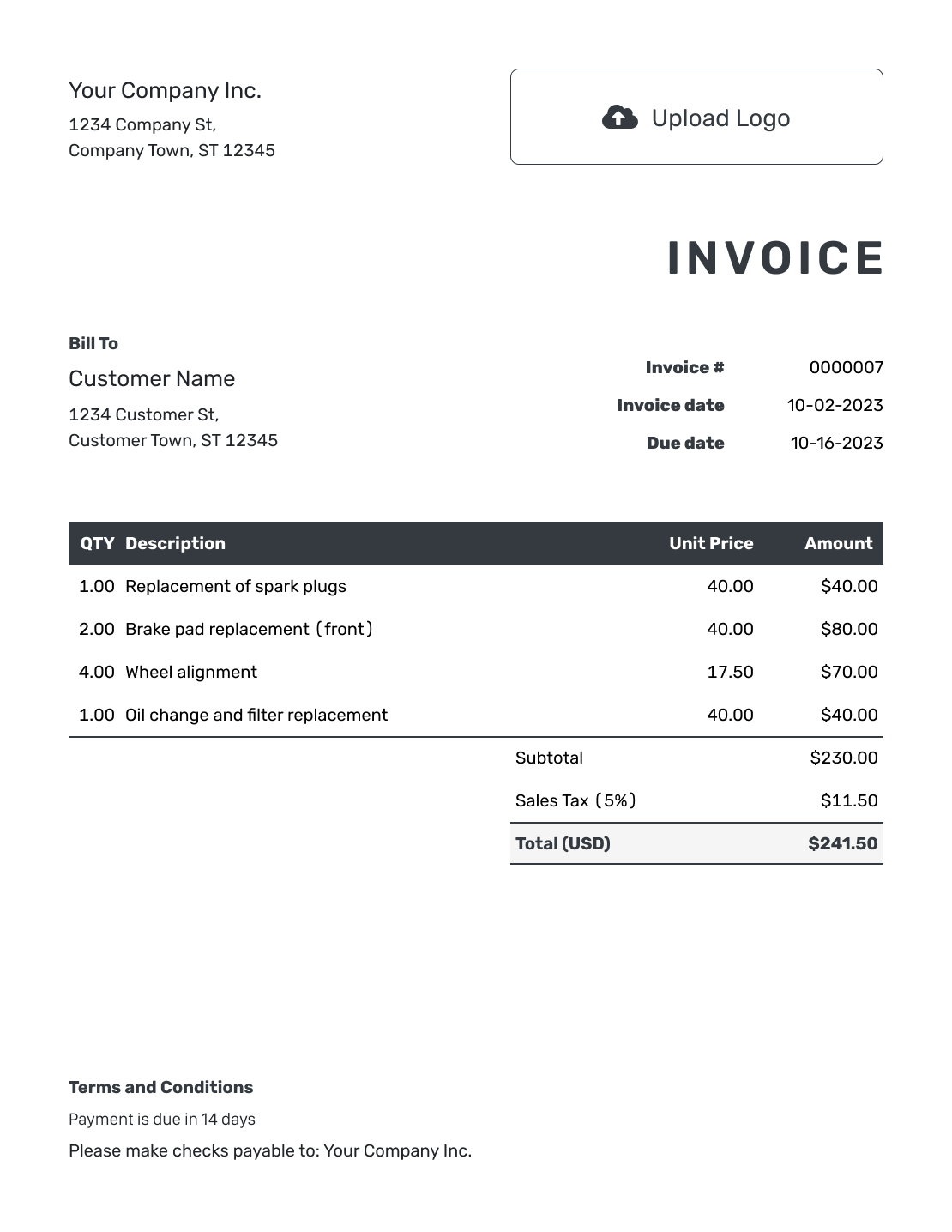

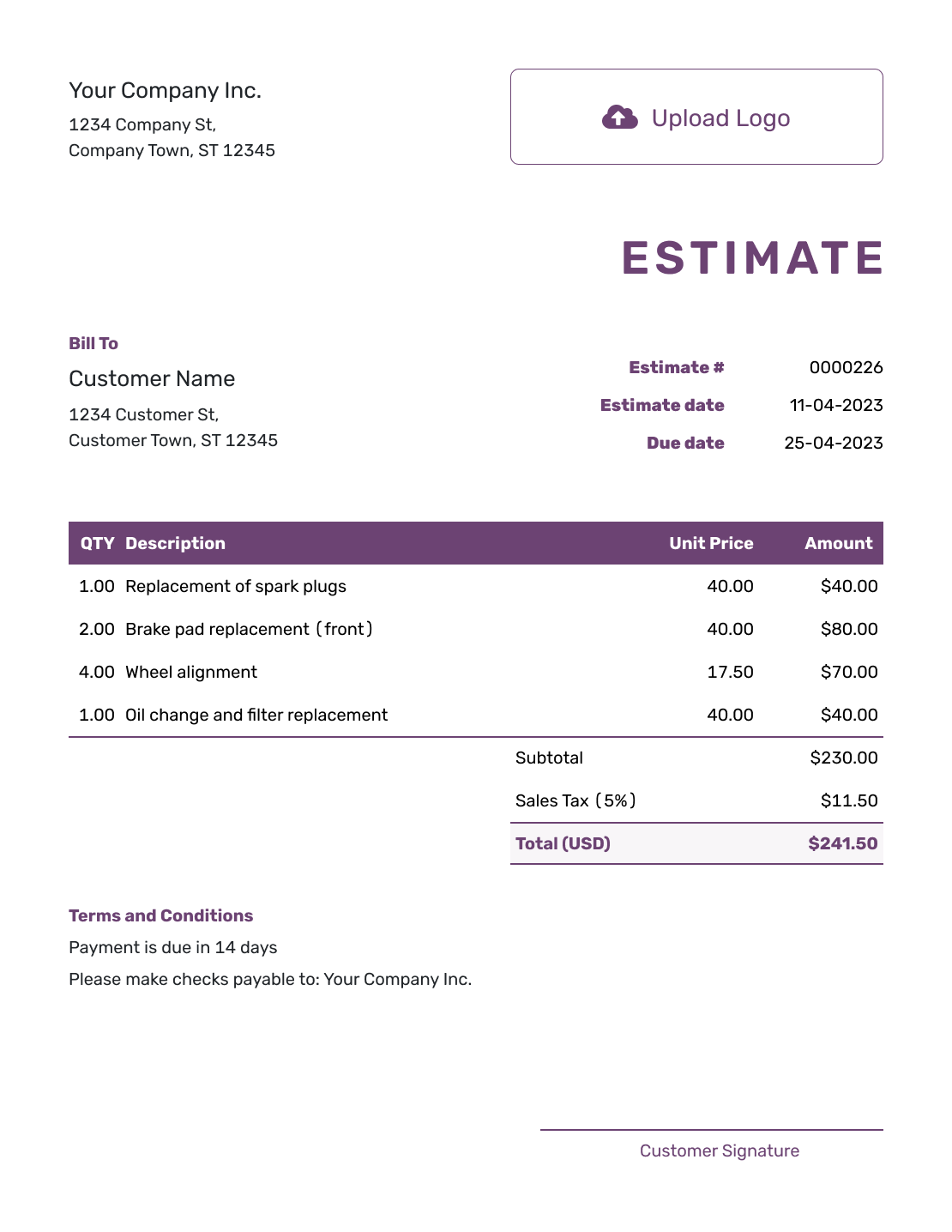

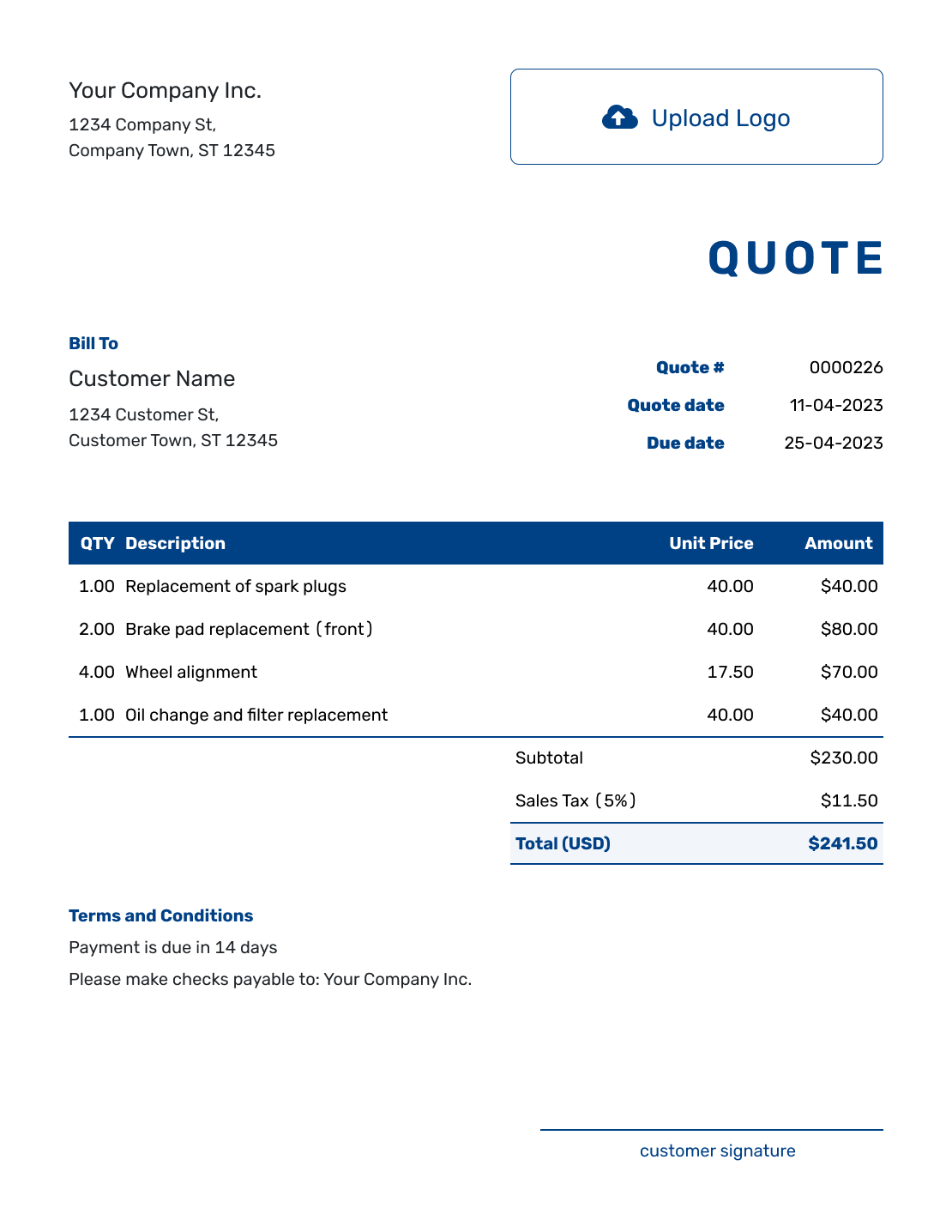

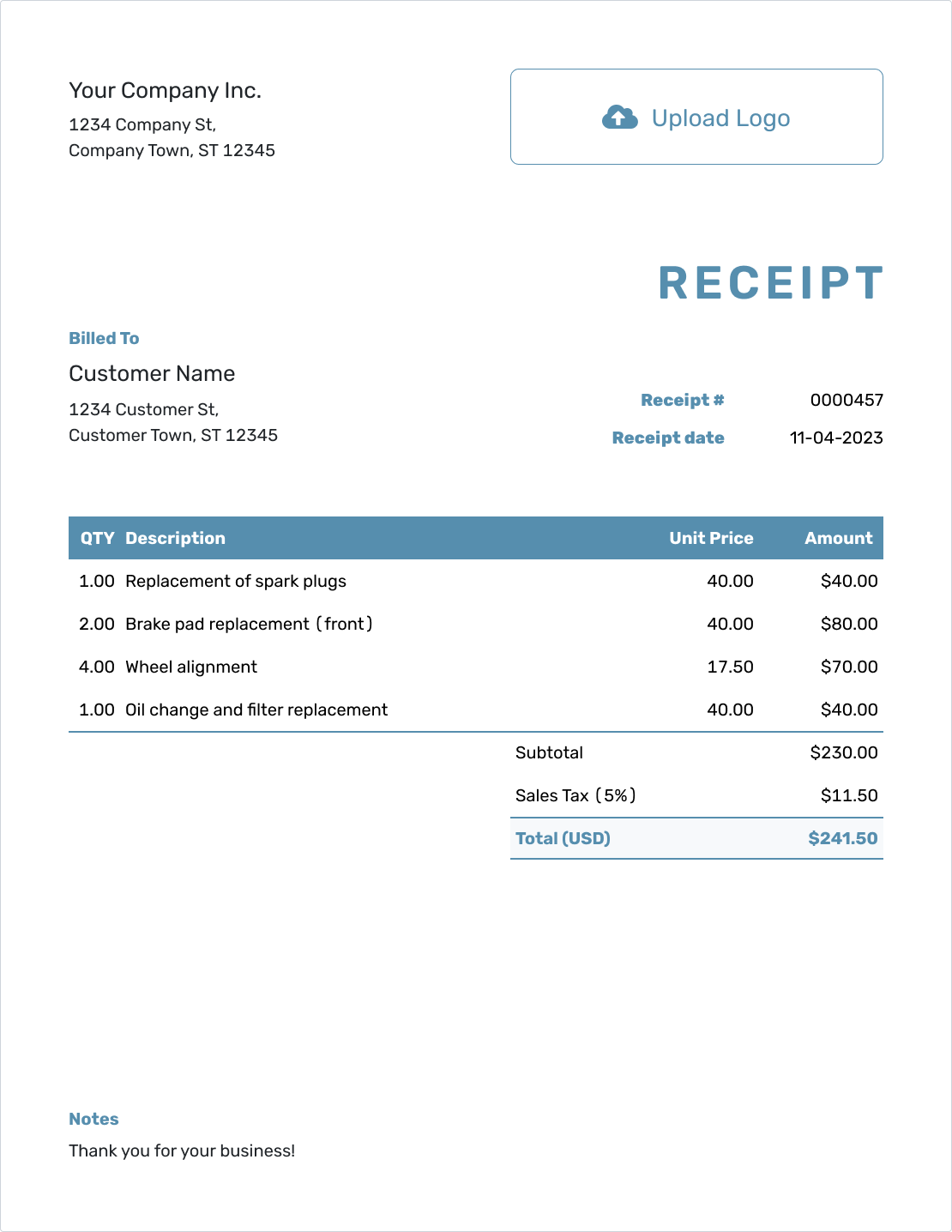

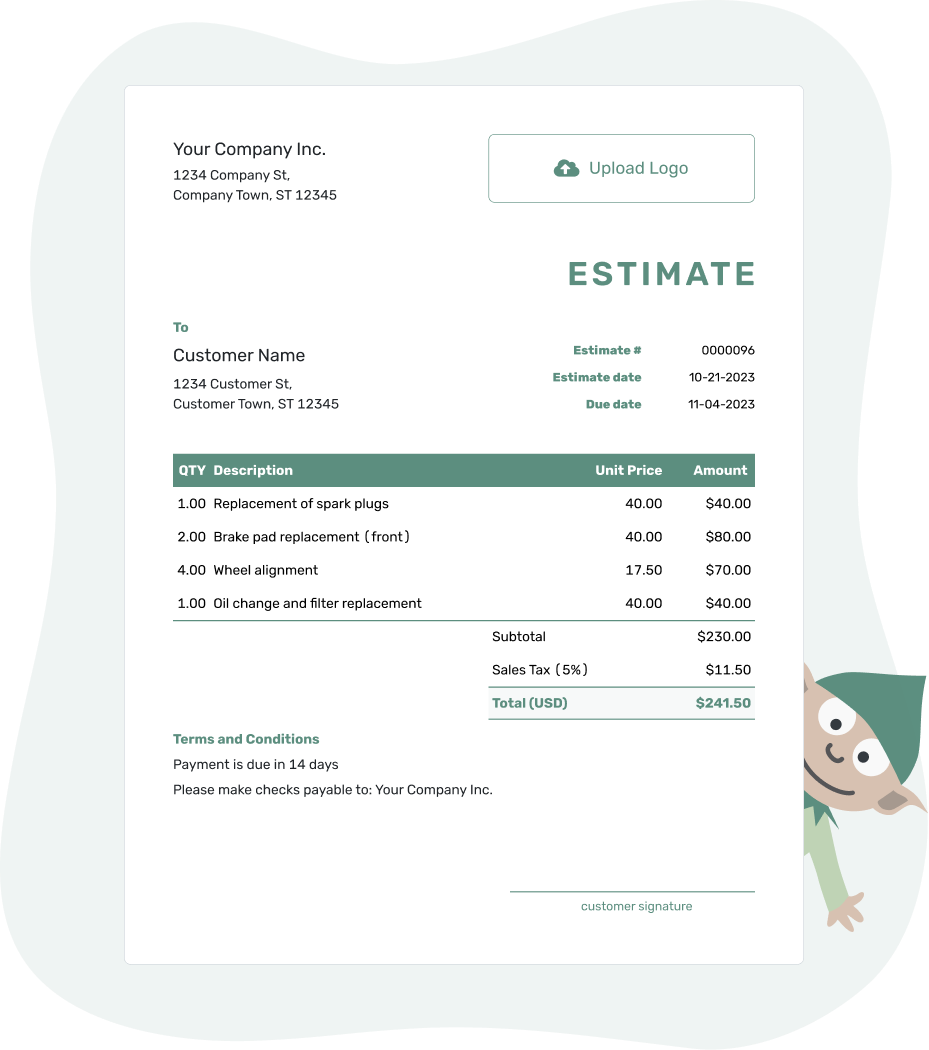

- PDF, Email or Print

- Convert to Invoice

- See when your estimate has been opened

- Get notified when your estimate is accepted

Word Definitions

-

Beginning Inventory:

The stock of goods a company has at the start of a financial period, which is used for sale or production during that period. -

Cost of Goods Sold (COGS):

The direct costs attributable to the production of the goods sold by a company. This includes both raw materials and labor costs used in the creation of the goods. -

Inventory Purchases:

The total cost of goods a company buys to replenish inventory over a period, intended either for resale or for use in production. -

Inventory Turnover:

A ratio showing how many times a company's inventory is sold and replaced over a period.

How to Calculate Beginning Inventory

Beginning inventory can be calculated if you know the ending inventory of the previous period, cost of goods sold, and purchases made during the period. The formula is as follows:

| Beginning Inventory = | Ending Inventory + COGS - Purchases |

Understanding beginning inventory is essential for accurate financial reporting and effective inventory management. It impacts several aspects of business operations, including financial statements, budgeting, and planning.

Examples of Calculating Beginning Inventory

Below are practical examples to help you understand how to calculate beginning inventory.

Example 1

If the ending inventory last month was $20,000, COGS was $10,000, and purchases were $5,000, the beginning inventory would be:

| Beginning Inventory = | $20,000 + $10,000 - $5,000 |

$25,000 would be the beginning inventory for the current month.

Example 2

A company's ending inventory at the end of the year was $30,000, COGS was $15,000, and purchases amounted to $10,000. The beginning inventory for the new year would be:

| Beginning Inventory = | $30,000 + $15,000 - $10,000 |

$35,000 would be the beginning inventory for the new year.

Inventory Turnover Calculation

Inventory turnover is a measure of how quickly a company sells through its inventory within a given period. It's a critical efficiency ratio for businesses that carry inventory, as it reflects how well inventory is being managed and can impact both cash flow and profitability.

Understanding Inventory Turnover

The inventory turnover ratio provides insight into a company's operational efficiency by indicating how many times a company's inventory is sold and replaced over a specific period. A higher turnover rate often indicates better performance, suggesting effective inventory management and high sales, whereas a lower turnover rate might signal overstocking or inefficiencies in the product line or marketing efforts.

How to Calculate Inventory Turnover

To calculate the inventory turnover ratio, you need to know the cost of goods sold (COGS) and the average inventory for the period. The formula is:

| Inventory Turnover Ratio = | Cost of Goods Sold / Average Inventory |

Where:

- Cost of Goods Sold (COGS): The total cost of all inventory items sold during the period.

- Average Inventory: The average value of inventory over the period, calculated by adding the beginning and ending inventory values and dividing by two.

Average Inventory = (Beginning Inventory + Ending Inventory) / 2

By understanding and monitoring inventory turnover, businesses can optimize their inventory levels to ensure they are neither overstocked nor understocked, balancing investment in inventory with sales output.

Frequently Asked Questions

-

What is beginning inventory?

Beginning inventory is the total value of a company’s inventory at the start of an accounting period. It includes all types of inventory that the company plans to sell.

-

How do you calculate beginning inventory?

Beginning inventory can be calculated using the formula:

Beginning Inventory = Ending Inventory + COGS - Purchases This calculation provides the value of inventory at the start of the period.

-

Why is beginning inventory important?

Beginning inventory is important for financial reporting, enabling accurate calculation of COGS and overall profitability. It helps businesses manage their inventory levels effectively, ensuring they have enough stock to meet customer demand without overstocking.

-

Why is it important to calculate beginning inventory?

Calculating beginning inventory is essential for accurate financial reporting and inventory management. It serves as the starting point for accounting periods, helping businesses track inventory changes, assess financial health, and ensure continuity in reporting.

-

What is the impact of inaccurate beginning inventory on business operations?

Inaccurate beginning inventory can lead to erroneous financial statements, affecting profitability analysis, tax calculations, and business decisions. It can also result in poor inventory management, leading to stockouts or excess stock, affecting sales and customer satisfaction.

-

What methods can be used to determine beginning inventory?

Beginning inventory can be determined using physical inventory counts at the end of the previous period, perpetual inventory systems, or through financial records if previous ending inventory figures are available. Each method offers different levels of accuracy and complexity.

-

How can businesses improve the accuracy of their inventory records?

Businesses can improve inventory accuracy by implementing regular inventory audits, using automated inventory management systems, training staff on proper inventory handling, and maintaining consistent documentation practices throughout the inventory lifecycle.

Further Reading

To deepen your understanding of beginning inventory and its calculation, explore the following resources:

- Investopedia's Article on Beginning Inventory - Provides a detailed explanation of beginning inventory, including how to calculate and manage it effectively.

- Accounting Tools on Beginning Inventory - Offers insights into various aspects of beginning inventory and its significance for business operations and financial analysis.